India’s Static Red Treasure, It’s Time to Make it Dynamic

At the outskirts of Delhi in Mehrauli, stands an Iron Pillar, which has withstood the adversities of time and has been corrosion-free ever since the bygone era. This marvel has intrigued metallurgists and material scientists from all over the world and is an ode to the rich history of India in the field of Metals & Mining.

The Metals & Mining sector is central to the economy of any developing / developed country. In the Indian context, we have not been able to maximize its potential due to a plethora of reasons such as lack of investment, lack of supporting infrastructure, high lending rates, low exports, distinction between captive and commercial mining, less focus on production in the mining sector etc. In this article, we will focus on one of the key levers that can propel the Mining & Metals sector in India - Increasing the production and export of Iron Ore while ensuring long term raw material security. This is much needed in order to increase the GDP contribution of the Indian mining sector which is abysmally low @ 1 %, enhance India’s share in the global trade basket and foreign cash reserves, generate more direct and indirect employment.

The total resource base of Iron Ore in India is estimated at 33 Billion Tonnes. Haematite and Magnetite are the most important Iron Ores in India. Iron ore is the primary raw material for the Iron and Steel sector and the extraction of Iron ore holds pivotal importance amongst all ore extraction activities. It is primarily used in hot metal production from Blast Furnaces/Mini Blast Furnaces, Sponge Iron production and production of iron bearing agglomerates in Sintering and Pelletisation units.

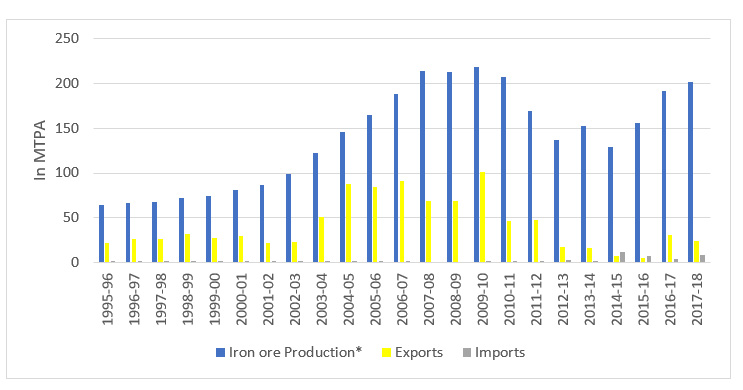

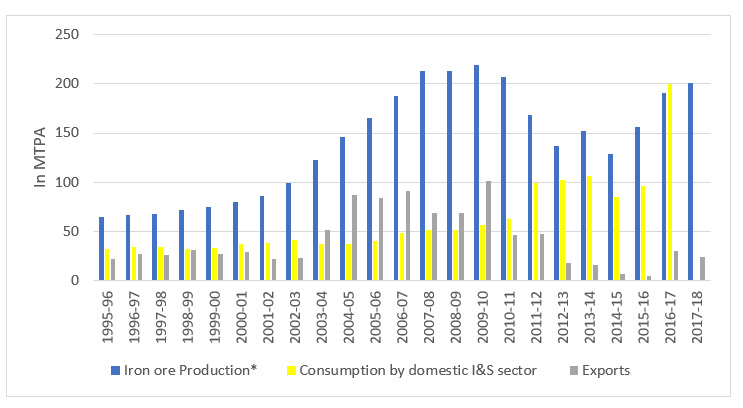

The following chart presents the trends in Iron Ore production, consumption and trade:

As we can observe from the above charts India’s iron ore production has been sufficient to meet the demand of the domestic industry, however the demand -supply gap has narrowed from circa 2011 onwards. This is majorly because of a nosedive in production, mining ban in some of the states and some of the port-based Steel plants finding it cheaper to use imported iron ore. The above data points also establish that the domestic Steel industry has been unable to ramp up the capacity to absorb the Iron Ore resource base in the country, duly leverage the cost advantage and promote the use of Steel despite abysmally low per capita Steel consumption in the country. At present, the overall per capita steel consumption in the country is recorded at 70 kg against a world avg. of ~ 210 Kg. It is important to note here that the per capita consumption in the rural part of the country is only 10 kg, which presents a significant untapped latent potential. The per capita consumption of steel is a direct indicator of the industrial and human prosperity of a country.

Taking cues from the Chinese economy, India too could have become a Steel producing, processing, and export hub with the right policy, infrastructure support, and investment in upstream and downstream allied sectors. In 1990, China produced 66 Million Tonnes of Steel (9 % world share) and India produced 14 Million Tonnes. Today China produces ~930 Million Tonnes, which accounts for ~ 50 % of the global Steel production. Investment in Steel and allied sectors such as Infrastructure, Heavy Engineering & Manufacturing sector has played a dominant role in turbocharging the growth of Chinese economy and we could have given strong headwinds to it by adopting a similar strategy. However, we missed that bus and instead gave tailwinds to the Chinese economy. It is interesting to note here that while the Indian Iron & Steel industry traces its origin to way back in 1870 with the inception of Kulti Iron Works (now ISP-Burnpur of SAIL) in West Bengal, the first Iron & Steel producing unit was set up in China only after WWI by the Japanese.

Basis the above, given the status quo, abundant Iron ore resource base, and the significant surplus, Iron ore exports should be allowed freely in the country.

Some of the direct benefits arising out of export of Iron Ore are as follows:

- With the shift towards resource efficiency and thrust on recycling, scrap based electric steel making may take over as the primary route in next 20-25 years. Therefore, it would be prudent to extract maximum benefit by exporting iron ore.

- Export would also facilitate utilisation of low grades stacked in mine heads and reduce risks of contaminations of water streams due to flow of silt in the monsoons.

- Exports would also promote investments in beneficiation of low grades due to hike in demand and potential of higher margins.

- Allowing export would also make the Indian Mining industry more competitive by integrating it with the global Iron & Steel value chain.

- Exports of Iron Ore has the potential to more than double the royalty collection of State Govts. And also contribute to railways by way of additional freight.

- Mining being low on cost intensiveness, capex required for additional capacities is trivially low when compared with steel making. Therefore, we can add capacity for exports at low capital investment and add direct & indirect employment to a large extent.

- Iron Ores of states such as Karnataka & Goa are friable in nature and it is metallurgically challenging for the domestic industry to process them. Also, states such as Karnataka lack perennial water source, which is a major pre-requisite for setting up an integrated Steel plant. These states do not have the same concentration of Steel Plants as the Eastern corridor and thus, allowing iron ore exports freely would greatly benefit these states and will have significant multiplier effect on the economy.

At the same time some of the key interventions needed by the domestic Steel industry in order to ensure long term raw material security are as follows:

- The domestic Steel industry primarily consumes +62 % Fe grade and most of lower grade ores those with lower Fe content and ultra-fines are left unutilized. ultra-fines are generated as a result of various extraction activities at mine sites and other operational & logistics activities in the Iron & Steel value chain. This problem can be alleviated to a great extent by adopting agglomeration of fines. As of now, there are two popular agglomeration technologies available- Sintering and Pelletisation. While the use of Sinter as an agglomerate has been widely adopted by the domestic industry, the use of pellets esp. by conventional producers (employing Blast Furnace route for Iron Ore making) has not really taken off.

- Sintering has limitations with regards to feed size and operational rigidity i.e. it can only operate as a part of an integrated steel plant having Blast Furnace route of Iron Making. Beneficiation & Pelletisation can overcome this issue because the process is designed primarily to utilize ultra-fines and can operate both as a stand-alone unit/ as part of an integrated steel unit, the product pellets can be fed to both Blast Furnace and DRI units driving superior performance, and it can be stored and transported over long distances thus simultaneously ensuring value addition along with raw material security.

- Increase in domestic consumption of Pellets utilizing beneficiated ore of below 62 % grade can result in several benefits:

- Ensure raw material availability and security alongside exports.

- India imports a huge quantity of Metallurgical Grade Coking Coal ~ 46.5 MTPA (~ 80-85 % of the total requirement) was imported in FY 18. This results in huge loss of foreign reserves and also leaves the industry vulnerable to supply chain shocks. Use of pellets can bring down the coke rate by 1.5 Kg/ T of Hot Metal Produced. Considering that the country produced ~ 68 Million Tons of Hot Metal in FY 18, use of more pellets can result in significant savings of foreign reserves.

- Indian Steel producers should produce more value-added products in order to absorb the higher transfer cost if any for incorporating beneficiated and agglomerated pellets. Presently the domestic industry does not produce required quantity of value added Steels such as Ship Building Steel, Head Hardened Rails for metro rail projects etc. and most of these Steels are imported leading to further loss of foreign reserves.

In Toto, we would like to reiterate that it’s time we provide motion to India’s static red treasure and leverage the latent potential of the Indian Mining sector. The sun has set for the Mining sector in some of the western economies but for us its early morning and it’s still the dawn.

*Ishtiyaque Ahmed is Adviser and Shantanu Rai is Consultant, NITI Aayog. Views expressed are personal.

National Portal Of India

National Portal Of India