Strategy for states to prepare and tune their EV policies

Transition to green mobility is quickly picking up and with the rapid decline in battery prices in the last decade from 1,000 $/kWh to 150 $/kWh (Expected to cost 100$/kWh by 2026) the Total Cost of ownership (TCO) of Electric Vehicles (EV) has become favourable compared to Internal Combustion Engines (ICE) in many segments (TCO for EV better than CNG vehicle in entry level Sedan segment for daily run of>180kms, a recent study by A.T.Kearney)

Grid electricity mix is definitely one aspect for the better TCO benefit of EV vs ICE. However, the right choice of battery, responsive Battery Management system, adaptable Controller, efficient motor, and advanced Battery recycling facilities will further support the case for EV adoption. It is estimated that 99.6% of the total gasoline consumption in India goes to automotive sector while diesel demand accounts for 67%. Therefore, 112 billion USD worth of crude oil import bill for year 2019 for the country can be majorly attributed to the Automotive Industry requirements. Although EV in India may contribute to around 50 grams CO2 equivalent/km (Considering 66% fossil fuel-based power generation | Compact car segment, vs ~120 g CO2 equivalent/km for gasoline powered vehicle) [1] from well to wheel, the zero tail pipe emissions, low maintenance, lesser wear and tear of parts, and end of life battery (and vehicle) recycling makes it inevitable to promote EV over ICE.

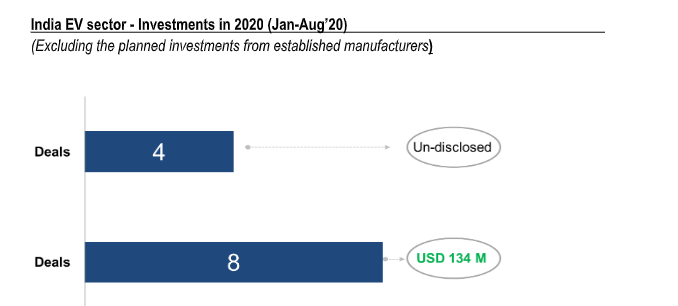

Post BSVI implementation, it has been argued that investments in EV may dry out, however in 2020 (inspite of global pandemic) alone, more than 134 Million USD worth of new investment has been seen in the EV sector in India (This is excluding the investments declared by the existing manufacturers). Further, the BS VI implementation, COVID generated personal vehicle demand, high retail prices of gasoline and diesel (Though crude oil prices are lower, Brent crude ~40 USD/Barrel), and urge for Green mobility transition makes a strong case for EV R&D, manufacturing, and early adoption in India.

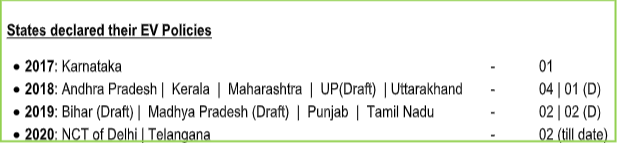

Till now 9 states have released their final EV policies (3 released the drafts), giving clear message of EV promotion from policy perspective. This also gives confidence to investors and early adopters about long term government strategy. Other states should also follow the route and expedite the policy declaration as soon as possible.

It is advisable for states to not replicate the policies adopted by other states, but be innovative and unique in their approach. Each state has a unique selling proposition (USP), which it offers because of demographics, talent pool availability, existing infrastructure, and state level regulatory environment (effective single window approvals etc.). NITI Aayog & DHI can support states in framing the customised policies. For instance, if Orissa can become the hub for cell manufacturing, then west Bengal can target the battery assembly. Resource distribution has to be targeted for entire EV Value chain with different states playing to their strengths.

Karnataka or Maharashtra can provide the suitable Information Technology (IT) support for BMS development in challenge mode and other IT related R&D for EV development. States with higher share of renewables can implement the Time of day (ToD) Tariff for charging to encourage the EV Charging during peak of renewables generation. Such distinguished policies also means that investors are not confused and have clear focus where to do what (plus long terms policy surety). If all states compete for manufacturing then the niche segment within EV and EV components manufacturing may be left out. This includes everything from Cell manufacturing, R&D, Battery assembly, EV manufacturing (2 Wheelers /3 Wheelers /4 Wheelers /bus/ small commercial vehicles/heavy Commercial Vehicles), EV Components manufacturing such as controller and motors and Battery (and vehicle) recycling.

End of life responsibilities of Manufacturers for the batteries should also be clarified in the policies to give further impetus for promoting circular economy.

It should also be noted by states, that they should be flexible in incorporating the feedback from industry, environmentalists, and citizen even after launching the policy (in a time bound manner). It’s an iterative procedure and needs to be aligned on contiguous basis. Other states preparing the policies should apply these learning to avoid the delay in implementation.

Given high lead time for cell/battery R&D (40-50% of EV cost) PSUs like BHEL, NTPC (In April’20 NTPC invited global expression of interest to provide 10 number each of Hydrogen fuel cell-based buses and cars in Delhi and Leh) can play a vital role in taking lead, generating alternate source of income, and diversifying the portfolio at initial stages. Investment in R&D by such firms will set the benchmark and encourage other private players to invest. This is an opportune time for India to take a lead in manufacturing and end of life management of battery (Circular economy) and EV (and its components). Swift EV policy announcements by all the states/UTs should be ensured to leap frog the mobility paradigm for Atma Nirbhar Bharat.

[1]:Woo, JongRoul & Choi, Hyunhong & Ahn, Joongha. (2017). Well-to-wheel analysis of greenhouse gas emissions for electric vehicles based on electricity generation mix: A global perspective. Transportation Research Part D Transport and Environment. 51. 340-350. 10.1016/j.trd.2017.01.005.

Randheer Singh (Senior Specialist), NITI Aayog. Views expressed are personal.

This interview was published in Times Of India.

National Portal Of India

National Portal Of India